As digital lending gains momentum and equity investments hit record highs, LAS is becoming a critical tool for wealthier individuals, growing retail investors, and proactive bankers looking to diversify their product offerings.

What Is Loan Against Shares?

Loan Against Shares is a secured credit facility where borrowers pledge their listed shares to access instant liquidity.Rather than selling their equity holdings — which may be held for long-term capital gains — borrowers can use those shares as collateral to meet business or personal needs.Borrowers retain ownership of the shares and continue to receive dividends and benefit from capital appreciation.Funds can be used for working capital, emergencies, business expansion, or opportunity investing.This lending product stands at the intersection of market intelligence and smart credit access.

LAS Market Size: A Fast-Growing Yet Underpenetrated Segment

India’s LAS segment is surging, reflecting growing investor sophistication and lender confidence.As of August 2024, total outstanding loans against shares and bonds stood at ₹9,722 crore, up 27% YoY — far outpacing the 14% growth in the overall personal loans segment.Despite this momentum, the LAS market remains underpenetrated, with current volumes representing less than 1% of the market value of listed securities.The estimated market size is under ₹1 lakh crore, compared to a potential of $100 billion (₹8 lakh crore).This gap presents massive untapped potential — especially as more investors open demat accounts, and awareness grows around LAS as an alternative to high-cost unsecured loans.

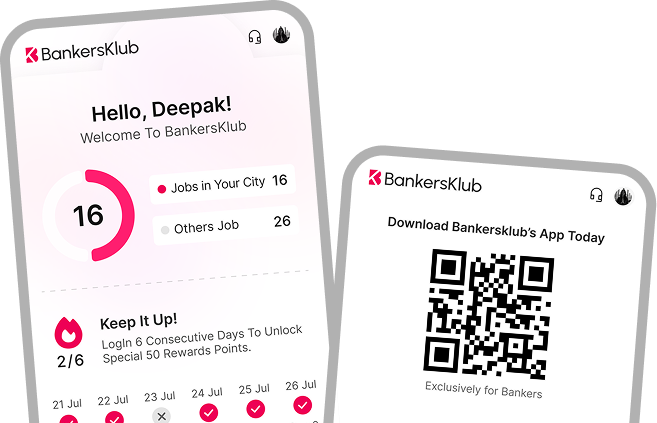

Explore the product on BankersKlub: https://bankersklub.com/products/las.

Who Should Consider LAS?

Investors & HNIs:

- Stock market investors looking to unlock liquidity without disrupting long-term holdings.

- Business owners and professionals needing funds for short-term opportunities or emergencies.

- HNIs using leverage strategies while retaining ownership of their equity portfolios.

Bankers & Financial Professionals:

- Bankers affiliated with BankersKlub can leverage LAS to offer clients low-risk, high-value solutions.

- The product allows for deeper engagement with high-net-worth clients and repeat usage as share values increase.

- With digital disbursement and paperless documentation, it’s an easy-to-distribute product.

Why LAS Is Growing Rapidly

Enhanced Liquidity Without Selling

Borrowers can access funds without liquidating their equity portfolio.This is especially helpful when markets are volatile or when stocks are held for long-term compounding.

Lower Interest Rates (9–12%)

Loans against shares come with significantly lower interest rates compared to unsecured personal loans (which often exceed 18–20%).This makes LAS a cost-efficient credit solution.

Flexible Repayment Options

Overdraft facilities and bullet repayment models allow borrowers to pay only the interest regularly and defer principal payments.This structure is ideal for managing cash flow efficiently.

Risk Mitigation for Lenders

LAS is a secured product.In the case of a borrower default, pledged shares can be liquidated, significantly reducing non-performing asset (NPA) risk for financial institutions.This security has made LAS increasingly attractive for banks and NBFCs facing rising delinquencies in unsecured lending.

Retail Participation and Digital Enablement

India’s booming retail equity investment trend — driven by a surge in demat accounts and investor apps — has expanded the addressable market.New-age LAS platforms, like BankersKlub, enable digital onboarding, seamless verification, and disbursement within 24–48 hours.

Whether you’re an ex-PSU banker or a private wealth manager, LAS allows you to unlock value from your network — while offering clients a smart alternative to traditional loans.

LAS: Smarter Credit for the Informed Investor

The growth of Loans Against Shares reflects a shift toward asset-backed, lower-risk lending in India's credit ecosystem.It’s a win-win: borrowers maintain investment continuity, and lenders reduce risk exposure.With a market potential exceeding ₹8 lakh crore and digital platforms like BankersKlub making distribution seamless, LAS is poised to become a cornerstone of modern lending in India.