Whether you’re a seasoned investor looking to meet short-term funding needs without redeeming your mutual funds or a banker aiming to serve this emerging borrower class, LAMF is an untapped goldmine. Let’s understand how.

What is Loan Against Mutual Funds (LAMF)?

Loan Against Mutual Funds allows individuals to borrow money by pledging their mutual fund holdings as collateral. It is a form of secured lending where the underlying NAV (Net Asset Value) of the mutual funds determines the loan amount.

This product provides a non-disruptive credit line, allowing investors to:

- Avoid premature redemption of long-term investments.

- Maintain market exposure and benefit from compounding.

- Access funds at relatively lower interest rates compared to unsecured loans.

Market Potential: A Multi-Lakh Crore Credit Opportunity

India’s mutual fund AUM has seen exponential growth, rising from ₹24 lakh crore in 2018 to over ₹68 lakh crore in 2025. Here’s why this is significant:

- Nearly 4 crore unique investors are now participating in mutual funds.

- As per AMFI, SIP accounts have crossed 7.5 crore, contributing ₹19,500+ crore monthly.

- Conservative estimates suggest that at least ₹15–20 lakh crore is held in equity and hybrid funds, eligible for LAMF underwriting.

If even 5% of eligible AUM is tapped for credit, the potential LAMF market size exceeds ₹75,000 crore annually. And this is just the beginning.

Did You Know?

Loans against mutual funds in India are estimated to range between ₹50,000 to ₹55,000 crore, while the Average Assets Under Management (AAUM) for the Indian mutual fund industry reached ₹68,04,761 crore in January 2025.

This rising demand for LAMF reflects a valuable opportunity for lenders, driven by a streamlined and rapid application process that attracts a growing borrower base. Unlike unsecured personal loans, which entail elevated risk for lenders and impose higher interest rates on borrowers, Loans Against Mutual Funds (LAMF) present a secure and cost-efficient lending model. Supported by robust mutual fund collateral, LAMF enables financial institutions to extend lower interest rates to borrowers while significantly mitigating their own risk exposure.

Who Should Consider LAMF?

For Investors / HNIs:

- Business owners seeking working capital without liquidating investments.

- Salaried professionals needing funds for large purchases or emergencies.

- HNIs looking for tax-efficient leverage strategies.

- Anyone aiming to keep their SIPs running while accessing funds.

For Bankers / Financial Professionals:

- LAMF provides a high-quality, low-risk product to offer to clients.

- Growing demand among informed investors for alternative credit options.

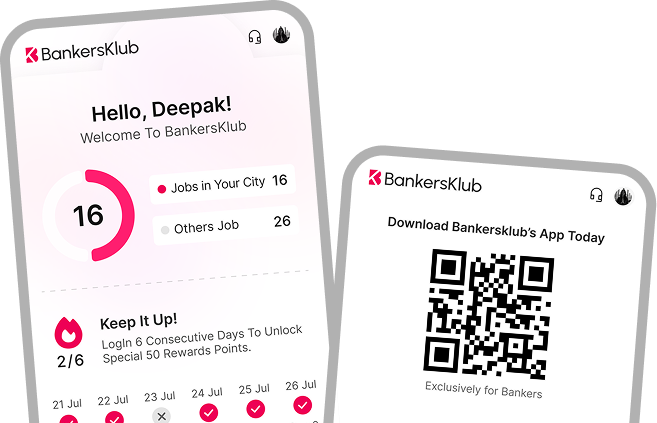

- Helps bankers build wallet share and drive meaningful engagement. Platforms like BankersKlub now empower experienced bankers to source, refer, and manage LAMF leads, unlocking fresh income opportunities.

Why LAMF Is Gaining Popularity

No Need to Redeem MF Units

Unlike redeeming your SIP or long-term mutual fund investment, LAMF allows investors to pledge units while keeping the portfolio intact.

Quick Processing, Minimal Paperwork

With digitization of demat accounts and CAMS/KARVY integrations, loan disbursement can happen within 24–48 hours.

Competitive Interest Rates

LAMF typically comes with interest rates ranging from 9% to 12%, much lower than unsecured personal loans.

Flexibility in Repayment

Options include overdraft lines, term loans, and bullet repayment — ideal for different borrower profiles.

Why Bankers Should Add LAMF to Their Product Suite

For active and retired bankers associated with BankersKlub, this product offers:

- High-conversion potential with mutual fund-savvy clients.

- Repeat business from the same portfolio with top-up requests.

- Digital-first processing backed by trusted fintech/NBFC partners.

- Transparent commissions and real-time tracking on the BankersKlub app.

Explore BankersKlub’s LAMF product: https://bankersklub.com/products/lamf

Conclusion: The LAMF Revolution Is Here

As mutual fund investments become mainstream in India, LAMF emerges as a smart, efficient, and flexible credit option. It empowers investors to meet their liquidity needs without sacrificing long-term financial goals.